Eastman Kodak warned investors about survival doubts in its August 2025 earnings report. The company lacks financing for $500 million in upcoming debt. Media outlets quickly reported potential bankruptcy scenarios, but the company responded the next day, calling the reports “inaccurate and misleading.”

Executives deny bankruptcy rumors and stress stability

Kodak said reporters misunderstood the SEC filing. Management insists it has no bankruptcy plans and remains confident it will repay, extend, or refinance debt before the due date. The “going concern disclosure” is required by accounting rules, not a business decision. Kodak used only $3 million in cash during the second quarter, primarily for growth initiatives. This represents significant improvement from the first quarter, and management says operations are stable and self-sufficient.

Pension deal could wipe out debt and buy time

The rescue plan centers on terminating its pension fund. The company expects $500 million when the transaction closes in December 2025. About $300 million arrives as cash, with $200 million in investment assets converted to cash. This infusion will essentially eliminate company debt. Currently, the company carries $477 million in term debt and $100 million in preferred stock. The loan agreements require using the $300 million cash to pay down term debt first. This would leave $177 million in remaining debt and preferred stock to address later.

Losses deepen as cash runs low

Recent financial results show company fragility. The firm moved from a $25 million profit last year to a $26 million loss this quarter while burning through $46 million in cash. That left only $155 million available. Shares fell 25% after the announcement. The company’s future depends on rescue measures that are not fully in its control. Management is relying on a pension reversion and debt restructuring, but both require outside approval and cooperation. Survival now rests on closing the pension deal and securing new financing.

Printing sector struggles add to the burden

The recent analog revival has provided unexpected relief for the struggling company. The firm began manufacturing more film at its Rochester, New York, facility as younger generations rediscovered analog photography. This gave management a small boost in a market many thought dead.

However, the company’s struggles mirror problems throughout the commercial printing industry. “Every major equipment manufacturer in commercial printing is feeling the same squeeze this year,” industry expert Dave Zhang told Fortune. “Customers are holding back on big purchases unless they absolutely have to. They need time and money. Time is hard to get, but if they can get the money, they might just rebuild this thing.”

How ignoring digital photography became the biggest error

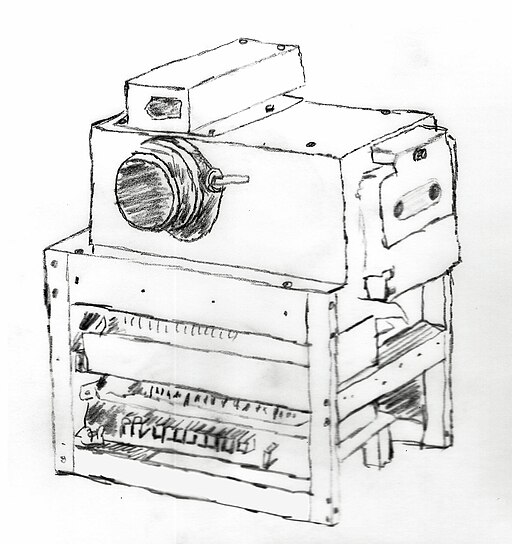

This crisis traces back to business history’s most painful irony. In 1975, company engineer Steven Sasson created the world’s first digital camera. The device was toaster-sized, weighed eight pounds, and captured images with just 100 pixels.

When Sasson showed his invention to executives in 1976, they asked a simple question. “Why would anybody want to take a picture this way when there was nothing wrong with conventional photography.” The marketing department showed no interest. Sasson was told they could sell the camera, but wouldn’t because it would hurt profitable film sales. Management reportedly said, “That’s cute, but don’t tell anyone about it.”

Kodak was once an industry giant, valued at $31 billion in 1997. In the 1970s, the company controlled 90% of America’s film market and 85% of camera sales. Its film was so iconic that Paul Simon wrote the 1973 song “Kodachrome” about it. Today, the firm is worth only $470 million and ranks as the 7,228th most valuable company in the world.

The company received a patent for Sasson’s invention in 1978 but never produced it. When the firm finally released its first digital camera in 1991, competitors had already embraced the digital revolution. Leadership resisted new technologies that might threaten film processing profits, even as the industry shifted. By the time management fully grasped the importance of digital photography, rivals such as Canon, Sony, Apple, and Google had already seized large portions of the market.

Layoffs, debt, and missteps pushed them toward collapse

The downfall quickened under CEO Antonio Pérez in the mid-2000s. According to industry expert Dave Zhang, Pérez “basically decimated” the company’s chemical and film operations. Management laid off tens of thousands of workers and sold off critical facilities, decisions Zhang said meant “they blew their future.” Overwhelmed by competition and burdened with $6.75 billion in debt, the company filed for bankruptcy in January 2012.

Read More: Home Improvement Chain, LL Flooring, Is Closing Down Over 400 Stores

Where the business stands today and its plans for survival

The company emerged from bankruptcy in September 2013, focused on commercial digital printing, motion picture film, and chemicals. Today, it operates three main segments while seeking new growth opportunities. The company focuses on digital printing solutions for commercial industries, advanced materials and chemicals for pharmaceutical manufacturing, and coating technology for electric vehicle batteries.

Management is completing an FDA-registered manufacturing facility to produce pharmaceutical products, starting with medical devices like Phosphate Buffered Saline. The company also plans to leverage coating technology expertise for the growing electric vehicle battery market.

The Kodak warning: why companies must embrace change

Steven Sasson now speaks to business audiences about avoiding his former employer’s fate. “I hear it all the time, ‘How can I avoid being the next Kodak?’” He says. “Think of oil companies worrying about electric vehicles. It’s difficult for companies that have been successful for so long to change their approach.”

The term “Kodak moment” itself tells the story. Once meaning something worth preserving, now a warning about what happens when companies ignore disruptive technology. Whether the 133-year-old firm can reinvent itself remains uncertain, but its journey from pioneer to bankruptcy survivor stands as a reminder that protecting yesterday’s profits can cost tomorrow’s survival.

Read More: 15 Million People’s DNA Data Hits the Market After Popular Testing Company Goes Bankrupt